It’s going to get a lot easier to dissolve corporations in Ohio

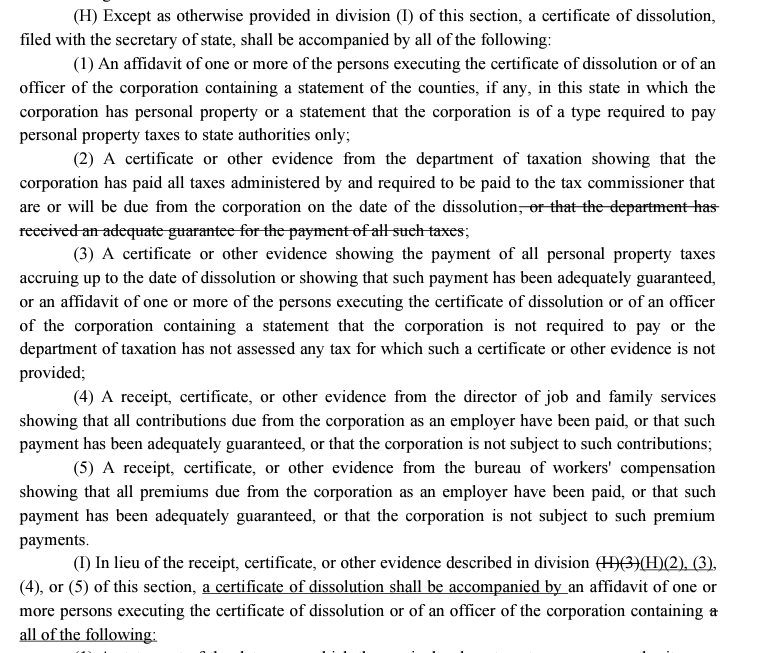

In 2013, the Ohio legislature amended Ohio Revised Code (ORC) to require that a dissolving corporation deliver a certificate from the Ohio Department of Taxation that the corporation has paid all its taxes (often referred to as a tax clearance certificate). ORC 1701.86(H)(2). This requirement was also listed on the Ohio Department of Taxation webpage for dissolution of entities.

This created practical difficulties because no one can control when the Ohio Department of Taxation would process the request for a tax clearance certificate.

Fortunately, the Ohio legislature adjusted this requirement in Ohio HB 301, and corporations are once again allowed to provide an affidavit certifying that the Ohio Department of Taxation was notified of the pending dissolution.

The changes to ORC 1701.86 effective 10/24/2024 are set forth below and available here.

This was a great change and will allow corporations to timely process a dissolution if that is what they need to do.

Comments are closed